ESG – The Integration Challenge

Corporates are facing two intense and inter-connected challenges currently – to Disclose and to Integrate their ESG-related activities. Though distinct, these twinned obligations have many commonalities, not least that they require significant investment in time and resource and hence cost. They also require significant cultural commitment and behavioural evolution. Neither are easily understood and yet the requirements for both are accelerating and, frankly, time is running out.

Over the coming weeks we aim to profile, clarify, and provide insight and solutions for all elements of these critical hurdles, reflecting the views of investors, corporates, advisors, and rating agencies.

We start with ESG Integration – itself a multifarious and multi-facted subject. The pressure on businesses to integrate ESG considerations into their strategy and business operations is real. It is being driven most explicitly by regulation but the pressure from investors and indeed wider society is no less intense. Investor Relations professionals, as a market-facing function and often the first point of contact for investors, are on the front lines of many questions with regards to a corporate’s approach to sustainability. However, ESG considerations cannot be the sole responsibility of the IR function and should be integrated on all organisational levels. Even so, many companies are still at the beginning of this journey.

We see five key elements of successful ESG integration:

- Senior Management Support and Accountability

- Materiality

- Strategy integration

- Communications and Reporting

- Regulatory Changes

This week we address the first of those: Senior Management Buy-In.

Senior Management and the Board: Buy-In and Accountability

Effective oversight from the board and senior management direction are necessary for both effective integration of ESG on a company level and communicating a convincing narrative to investors.

Well-informed top management is more likely to effectively incorporate the relevant ESG-linked risks and opportunities into strategy and ensure its adoption within a company. This view is supported by 58% of issuers who took part in our ESG White Paper, who observed that ESG strategy should be approached top-down, from the CEO and the board. Many corporates expressed that senior management conviction sets the correct ‘tone from the top’ that is likely to translate to a more enthusiastic uptake throughout organisational structure. Diego Martínez, Senior IR Manager at Iberdrola, highlighted the importance of setting the right tone: “Firstly, company management has to be convinced of the ESG trend. It would be very difficult to get a specific department to convince the rest of the organisation about the necessity of going in that direction, so the top management need to inspire the rest of the organisation. Introducing the Social Dividend in the Bylaws of the company several years ago was a key step in this direction.”

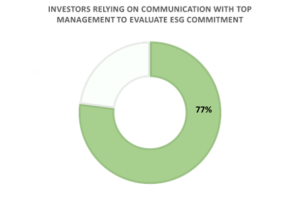

Senior management knowledge and conviction are especially important in light of 77% of investors indicating that they rely on communication with top management to evaluate companies’ commitment to ESG. Their responses suggest that management’s awareness of a company’s approach to ESG and the main relevant issues can be crucial in the investment evaluation process. Cindy Rose, Head of Responsible Capitalism at Majedie, illustrated how senior management’s understanding of sustainability influence investment decision-making: “If a company CEO or the CFO don’t know about the issues that their company faces and refer us on to talk with somebody else in the company, then that may send a poor signal. We’re happy to talk with other company reps, but we might also get the impression that that management doesn’t understand the material issues for their group, and that is concerning. That might make us question our conviction in a holding.”

Establishing board-level accountability along with integrating ESG into internal processes and risk management structures can help companies demonstrate their commitment to ESG. May Jaramillo, European Head for Sustainable and Impact Banking at Barclays Investment Bank, commented on the importance of accountability in creating a positive perception of a company: “ESG investment is about setting up a strategy that really demonstrates to your investor base that ESG is an integral part of the business, and no longer just a part of your PR. With the number one question being: who is accountable for your ESG policy? Accountability is very important, as it will show how meaningful it is to the board and the direction the company is heading in.” Current practice on this topic varies between specific board appointments based on ESG credentials, establishing sustainability as part of the responsibilities of all board members, or making the head of sustainability a board-reporting role.

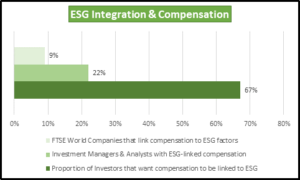

ESG Integration through Compensation

One of the most explicit ways to focus Senior Management and sub-board Executives is through linking compensation to ESG mile-stones and targets. This form of alignment through LTIPs and Bonus structures is gaining momentum but is a very small proportion of companies and a relatively small driver within overall compensation – often around 10% and very rarely exceeding 20%. This will change as a driver of and a consequence of effective ESG Integration for three reasons:

- It will challenge and motivate change in executive behaviours

- Senior management will want to be judged on ESG metrics if they are committed to delivering on them. And

- Investors will recognise and reward the alignment that these structures create: what gets measured, gets done.

In the meantime, the gap between investors’ preferences and corporate behaviour is material as shown below:

Meaningful ESG integration cannot be achieved without the support of company leadership: top management and the board have the key role of integrating ESG into the corporate strategy and monitoring its implementation on all organisational levels. A proactive and informed approach to ESG-linked risks and opportunities, reinforced by appropriate governance and accountability structures will allow companies to progress on their sustainability goals and effectively communicate with their stakeholders.