Is ESG only for companies that can afford it?

Over recent years, ESG has become a prominent part of the agenda for regulators, investors and issuers alike. Even the global upheaval caused by COVID-19 did little to remove ESG from the list of urgent concerns. On the contrary, social and governance factors are now taking centre stage as society and investors watch how businesses are responding to the pandemic. Despite this, for some small and medium-sized companies, ESG can seem a costly exercise without clear payoff.

While the current uncertainly around ESG standards and frameworks can be intimidating, it is important that companies understand the negative consequences of overlooking ESG in their strategic decision-making. A good way to look at the cost of ESG implementation is as a trade-off between the necessary expenditure and potential losses brought by mismanagement of ESG factors. In other words, the question should be: Can any company afford to not make ESG part of its overall strategy?

Why is ESG integral to companies’ resilience? Changing societal expectations, regulation, and investor attitudes

One of the important drivers behind the importance of ESG is changing consumer attitudes. Numerous high-profile scandals involving human rights and labour issues in companies’ supply chains show that mismanagement of ESG factors can bring significant reputational damage. In addition, consumer preferences are increasingly shifting towards sustainable products and services – a trend that will only intensify with generational change. Companies that are slow to adapt to the growing demand for sustainability are likely to see their customer base significantly reduced.

Many regulators have also been clear in their desire to address climate change and facilitate transition to a green economy by directing the capital flows towards sustainable businesses. The EU provides the most comprehensive framework to date, with the creation of a classification of sustainable activities in the EU Taxonomy, and mandating new sustainability-related disclosure obligations for companies and financial institutions. The UK Green Finance Strategy, introduced in 2019, aims to facilitate integration of ESG factors in financial decision-making, as well as support financing of green projects. Most recently, this commitment has been reinforced by the UK Chancellor’s announcement that TCFD-aligned disclosure will become mandatory in the UK by 2025[1]. Other large economies are also increasingly addressing the challenge posed by the climate change, with Japan[2], China[3], and South Korea[4] pledging to achieve carbon neutrality by 2050-60.

The majority of investors are also aware of the risks and opportunities arising from ESG factors. My-Linh Ngo, Head of ESG Investment at BlueBay Asset Management outlines why ESG concerns should be integral to all companies: “…for me, accounting for ESG just makes good business sense. If you think about, all businesses are made up of people or different stakeholder groups. Now these could be internal, like your staff; or external, like your customers, competitors, regulators or people in the local communities the company operates in. Understanding the nature and quality of those relationships and managing these to enhance them is not an optional add-on, it’s actually core to your business. If you don’t manage these intangibles as it were – these could get degraded – and could then have a negative impact on the company’s long-term financial sustainability.”

With ESG integration increasingly becoming standard in investment analysis, companies that fall behind in their approach to sustainability can lose existing investors and struggle to attract new ones. The ongoing regulatory effort to re-orientate capital towards sustainable businesses is one of the major factors behind investors’ increasing appetite for ESG. The recent announcement that Scottish Widows is planning to divest from companies that are involved in coal, controversial weapons or have violated global human rights or labour norms is a good illustration of this process[5]. This decision seems to be largely driven by the view that these companies are exposed to significant levels of regulatory risk, as well as shifts in consumer and investor attitudes. Of course, many investors will not immediately divest – companies in transition can present a unique opportunity to engage and facilitate change. But this approach still requires companies to recognise their shortcomings and be willing to address relevant ESG issues. The exponential growth of green bonds (reaching over $200bn in 2019[6]) and sustainability-linked loans shows that ESG factors also are becoming increasingly important in debt financing.

Finally, ESG is now a prominent consideration in M&A transactions. With ESG being an important consideration for the majority of stakeholders, parties need to evaluate potential sustainability-related risks and opportunities that a transaction can bring. A negative assessment of ‘ESG compatibility’ might have a significant impact on decision-making in M&A processes[7].

Considerations outlined above show that ESG is integral to future success and resilience of all companies and needs to take centre place in corporate strategy. Robert De Guigne, Head of ESG Solutions at Lombard Odier Investment Managers summarised potential negative consequences of overlooking material ESG challenges: “Sustainability challenges obviously affect different industries unevenly, which requires a very detailed assessment of sectoral risks. The main risks may arise throughout a company’s value chain, from the supply chain management to the interactions with all stakeholders in direct operations, as well as though the impact of products sold. For industries with a long and complex supply chain, including natural resources sourcing or manufacturing processes in countries with low production costs and weak legislations, human rights violation and environmental degradation may represent major risks. For players involved in mobility or energy solutions, compliance with greenhouse gas reductions goals and innovation in clean technologies may be crucial. Good management of ESG issues comes at a cost to the company, but poor management of these risks can be much more painful: operational inefficiencies, regulatory sanctions, consumer disinterest, delays in new investments, and even business closures.”

Minimising ESG costs

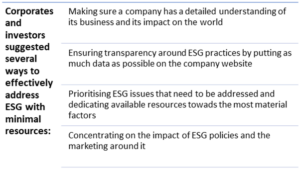

Most corporates recognise the dangers of disregarding ESG. Our ESG White Paper, published in September 2020, shows that 67% of issuer participants agreed that a lack of a comprehensive ESG policy can have a significant negative impact on a business. However, the cost issue remains a concern for many, especially with companies battling current pandemic-induced economic difficulties. Small or mid-sized businesses without a well-staffed sustainability department can struggle to address varying ESG-related demands of investors, ratings agencies, and other stakeholders. To address this challenge, we asked the participants of our White Paper to suggest several ways of effectively addressing relevant ESG concerns with minimal resources.

Most suggestions revolved around the need to understand what impact a company has on the world and its stakeholders and address that impact. This understanding should be informed by a materiality assessment, which will uncover ESG factors that are material for a particular business. Focusing on these factors will allow companies to prioritise and allocate available resources more efficiently. Another popular suggestion was to streamline reporting by placing as much ESG data as possible on a company website, preferably in a quantitative format. Many investors highlighted that they appreciate transparency and measurability in ESG data, which means that they prefer succinct information presented in tables that reflect historical performance. Placing this data on a corporate website saves costs and ensures that it can reach a wider audience. Maria-Elena Drew, Director of Research for Responsible Investing at T. Rowe Price illustrated the advantages of quantitative reporting: “If you do one thing, take the key data points, put them in a table that AI can read – that just means clear data points with no text, and put that on the website. That way, the AI tools used by ISS, Sustainalytics, MSCI ESG and other ESG ratings vendors can easily collect your data.”

In the global transition process to a low carbon, sustainable economy, ESG has become an integral part of a company’s long-term strategy regardless of its industry or size. A company that does not address its material ESG challenges is likely to face reputational and regulatory risks, and struggle to obtain financing. While most investors recognise that implementing change can be costly, it is possible to achieve meaningful impact with limited resources.