Qiagen is a $12bn Dutch-incorporated molecular diagnostic and testing company with listings in Frankfurt and New York. It has been an exciting and tumultuous time for the company since an October 2019 profit warning with a CEO departure, informal M&A approaches, a stated standalone strategy followed by a recommended offer from Thermo Fisher, the Covid-19 pandemic (Qiagen is a global leader in testing), an activist attack leading to an enhanced offer but the deal ultimately failing, further activist interest, ongoing share price strength, etc.

Investor Update has worked intensively with Qiagen since the profit warning, accurately tracking its investors in real-time with over 30 full IDs and multiple updates, allowing the company and its advisors to monitor and engage with its rapidly evolving shareholder base. Unsurprisingly the churn has been high, with hedge fund ownership increasing from 5% in October 2019 to 20% 12 months later. The top of the register shifted dramatically with a flurry of buying from activists and event funds but was preceded by an increase in broker positions that Investor Update was able to track and match up with specific funds. So we could tell the client what was happening where and when, including a rotation of activists following the deal from deal players to more strategic activists (activists peaked at over 20% ahead of the vote).

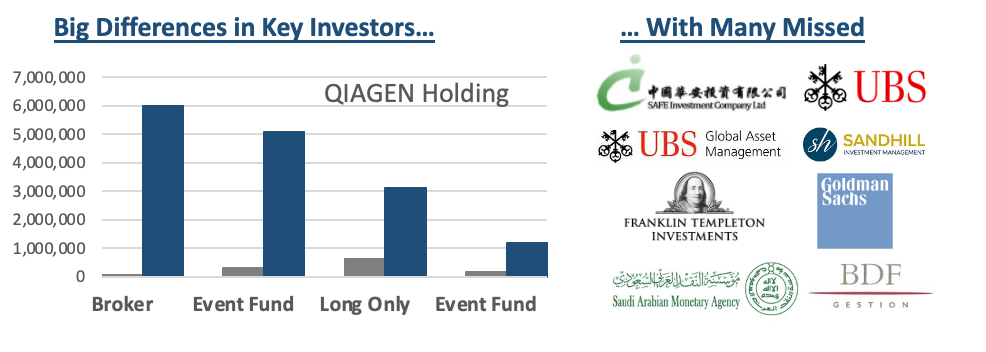

Of note was the side-by-side shareholder ID that Thermo Fisher’s advisor (a leading Proxy specialist) ran alongside Investor Update in June 2020 with startling results. Our competitor missed 20% of the top 100, with a reliance on filings data that showed outdated positions – Investor Update had 2.5x more direct disclosures from investors than the other provider. For example, Investor Update showed a 6m position for a broker vs 50 (fifty) shares at the competitor, a position that subsequently flipped into Davidson Kempner shortly afterwards, who rapidly became the top investor and key agitator for an increased offer price. Multiple similar stories for many other investors (an event fund at 5.1m shares vs peer’s 0.3m, or LO at 3.1m shares vs 0.6m) but our competitor also missed many holdings completely, such as SAFE, UBS AM, UBS (broker), Goldman Sachs (broker), Franklin Templeton, etc.

Accurate, detailed data is crucial in a sensitive, fast moving M&A situation to keep a target and its advisors on the front foot. Outdated filings data will not help – you need direct disclosures to understand what is happening in real time, including positions being built through brokers. Investor Update has unmatched buyside relationships to maximise such direct disclosure and the unparalleled experience to track and match broker positions to specific funds.