If the company addresses the opportunities from an accurate and detailed Share ID, then absolutely! A great example is TAG Immobilien, the Hamburg-based German residential real estate company (€3.7 billion market cap). TAG mandated Investor Update for their first ever Share ID in October 2019 and we delivered their second latest ID in October 2020 – management and IR took on board the opportunities the first ID presented and the progress in the last 12 months is a clear validation of their efforts.

Investor Update’s analysis in October 2019 had few surprises at the top of the register, but gave the company detailed colour further down the register, putting positions to institutions they knew, to ask about those they didn’t, to question broker positions, etc. The register was a good one, broad in terms of numbers and geography, with some very high-quality long only institutions at the top. However, there were some issues and opportunities: the top-heavy nature of the register posed a risk (the top 10 represented close to 50% of issued share capital); and the UK and Netherlands were relatively under-represented vs the domestic and US markets. Perhaps the biggest revelation was our Absentee Analysis in what is a fairly homogenous sector, identifying a number of blue-chip institutions invested in the majority or all of the peers but not our client – TAG knew almost all of them and so the company had clear takeaways and a list of target institutions from the analysis.

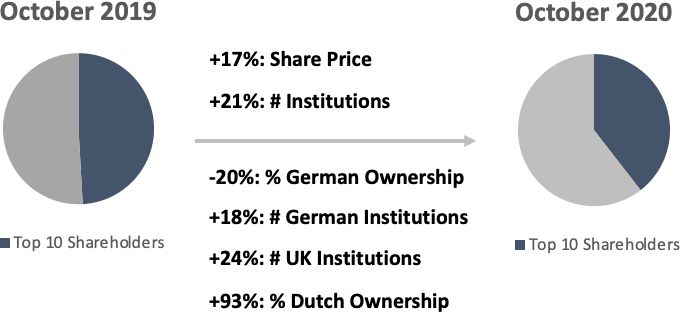

Great progress, more balance 12 months later… IR and management incorporated these opportunities into its IR strategy and it has certainly paid off. The overall number of investors has increased by over 20%, with dozens of new entrants; the German overweight has been reduced, with the domestic market representing 20% less of the issued share capital than 12 months ago, yet with many more institutions invested, highlighting greater diversity and balance; the UK has increased relative to the US; and the Netherlands, a key Real Estate specialist market, almost doubled in terms of number of institutions and overall ownership. This broadening of the investor base facilitated some selling from the top of the register – 3 of the top 5 institutions trimmed positions over the last year yet this was easily absorbed by broader shareholder base (shares up over 15% in last 12 months), resulting in a healthier, less concentrated top of the register, with the top 10 down almost 10% points to under 40%. And perhaps most satisfying, 2 of the 4 biggest absent investors a year ago are now significant TAG shareholders, as well as a further 5 institutions in last year’s top 30 absentees. Very strong progress, with plenty more to go for.

Martin Thiel, CFO of TAG Immobilien, added, “Investor Update’s detailed analysis clearly identified several opportunities to improve our shareholder base and certainly was an important input to our IR strategy. The results speak for themselves.”