Corporate strategy: ESG integration as a driver of resilience

This overview focuses on Corporate Strategy, continuing the series of posts on the five key elements of successful ESG integration launched by the ESG Advisory Team in Dec 2020.

Most stakeholders, including investors, increasingly recognise ESG factors as key to long-term value creation. However, some companies continue to view ESG through the marketing lens, aiming to capitalise on increasing interest in sustainability from investors and consumers. Due to the underdeveloped state of ESG disclosure and evaluation methodologies, this approach can temporarily attract positive publicity and some ESG-focused investment. However, it is not a viable long-term strategy. Investors are developing increasingly sophisticated methodologies in their search for sustainable investment opportunities, and regulators are moving to limit greenwashing. In fact, by approaching sustainability as a marketing tactic companies are blocking their own ability to reap the benefits of ESG integration. These benefits include stronger stakeholder relationships, lower cost of capital, reputational gains, and increased resilience to shocks linked to environmental and social factors.

“…leading organizations of the future will be defined by their ability to manage the global implications of concurrent catastrophic events.” – Greg Case, CEO of Aon

The virtues of healthy governance structures are widely accepted. Board independence, remuneration linked to improvements in financial performance, transparency, and accountability are recognised as conditions key to long-term success. Effective integration of environmental and social factors is just as important. In addition, ESG integration is becoming a necessary element of corporate governance.

Companies that fail to consider material environmental and social factors in their strategy are exposed to erosion in value, especially in the long-term. Climate change and biodiversity loss are predicted to result in trillions of dollars of economic damage, as well as tremendous negative impacts on the ecosystem and human population. Businesses worldwide have been experiencing the physical effects of climate change for a number of years, with examples ranging from shipping and supply chains disrupted by drought[1] to real estate assets being damaged by regular wildfires in the US. According to Aon, 2020 brought 416 natural disasters resulting in $268 billion of losses[2]. At the same time, the need to climate-proof corporate strategy does not stop at the physical damage from extreme weather events. The societal and regulatory response to these challenges necessitates a significant shift in business practices for many industries.

Environmental Engagement

Consumer preferences are increasingly shifting towards companies that make a substantial effort to minimise their negative impact on the environment (65% of British consumers want to spend money on sustainable products or services[3]; 74% of European consumers express a preference for sustainable packaging[4]). Governments in the UK, EU, New Zealand, South Korea, and other countries are responding to the climate crisis with a range of measures including carbon taxes and increasingly stringent disclosure requirements, with a focus on directing private capital towards sustainable investments through developing regulatory frameworks. Companies that do not respond to these developments are likely to experience a shrinking customer base, reputational damage, reduced productivity, a fall in employee engagement, and an increasing regulatory burden. On the other hand, businesses willing to adapt and innovate will take advantage of the opportunities presented by the surge of investment in the developing sustainable economy. Ørsted, a Danish offshore wind producer, is a case in point: once a coal energy company, now it is one of the leaders in green energy, intending to be 100% focused on renewables by 2025. This transformation was rewarded by the market, with Ørsted’s shares significantly outperforming their traditional energy and utility peers.

Social Responsibility

Business success is inextricably linked to social developments. Companies consist of people and function within a society; therefore, employee base, societal trends, and perceptions have a significant effect on the financial performance of all businesses. Employee welfare has been frequently linked to improvements in productivity. A diverse talent pool can have a significant impact too: gender and racial diversity have been repeatedly linked to improvements in financial performance, innovation, and corporate culture[5]. The external perception of a company’s ESG track record influences the ability to attract and retain talent as well as consumer and investor behaviour: employees are increasingly preferring to work for companies with a better ESG profile; sustainability policies are found to raise the levels of retention and workforce engagement[6]. Companies that want to ensure their business remains successful cannot ignore the mounting evidence and increasing stakeholder pressure to improve their approach to both human capital and the environment.

Strategic Integration

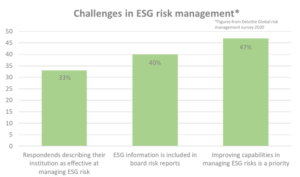

Many recognise the urgency and strategic importance of these issues – The 2020 Global risk Management Survey from Deloitte showed 47% of respondents prioritised ESG risks, including climate change and social-linked concerns. However, only 33% could report that their institutions effectively managed ESG risks.[7] For nearly 70% of financial institutions to admit that they do not have confidence in their ability to manage ESG risk is a severe inditement on their industry and highlights the urgency of the challenge at hand. To fully address these risks and opportunities, companies need to integrate environmental and social concerns into all business processes, including corporate governance and risk management. This remains a challenge for many companies, with one of the barriers being a lack of relevant expertise at a leadership level. According to recent data, most board members lack competency in ESG issues material to their companies, including climate change, water, cybersecurity, and human rights[8]. Establishing a corporate strategy that addresses key business risks and monitoring its implementation are fundamental board responsibilities. Directors need a sufficient level of expertise to consider environmental and social concerns in that process – a board member who understands the science behind climate change is more likely to identify the relevant physical and transitional risks, evaluate the environmental impact of the business, and address these factors in the business strategy. Directors with a relevant background would also be able to meaningfully challenge senior management and establish accountability on ESG issues. Finally, and perhaps most importantly, the ‘tone at the top’ is key to embedding sustainability in corporate culture, which is an essential element of successful integration.

Stakeholder Perspectives

Last year we asked several leading European companies and investors about their approach to ESG strategy in our White Paper. The results were encouraging, with many respondents maintaining that ESG topics should be embedded into all strategic considerations and not treated as a separate concern. With the increasing regulatory and stakeholder pressure, the number of market players integrating ESG concerns into their strategy will continue to rise. Despite all challenges, the current trajectory towards stakeholder capitalism is making ESG integration a clear requirement for long-term business success.

For further information on how we can help you develop your ESG disclosure approach,

please contact:

Andrew Archer

Partner – Head of ESG Advisory

Investor Update – 28 King Street – London EC2V 8EH

T: +44 20 3695 9698 – M: +44 759 261 0454

E: aarcher@investor-update.com

L: aarcher@LinkedIn.com

[1] https://cen.acs.org/business/economy/Low-flowing-Rhine-shuts-BASF/96/i48

[2] Aon, Weather, Climate & Catastrophe Insight 2020 Annual Report

[3] https://www.circularonline.co.uk/news/consumers-demand-greener-products-in-wake-of-pandemic/

[4] Trivium Packaging, 2020 Global Buying Green Report

[5] Rocío Lorenzo, Nicole Voigt, Karin Schetelig, Annika Zawadzki, Isabelle Welpe, Prisca Bros, The Mix That Matters: Innovation Through Diversity, The Boston Consulting Group, 2017; Dieter Holger, The Business Case for More Diversity, The Wall Street Journal, 26 October 2019

[6] https://transform.iema.net/article/sustainability-key-attracting-and-retaining-workers-study-finds

[7] https://www2.deloitte.com/us/en/insights/industry/financial-services/global-risk-management-survey-financial-services.html

[8] Tensie Whelan, US Corporate Boards Suffer from Inadequate Expertise in Financially Material ESG Matters, SSRN https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3758584